Is HomeSense positioned to win in home goods?

The home goods market has experienced a tough couple of years. In 4Q23, the industry continued a 8-quarter streak of negative sales growth, as sales declined -4% YoY.

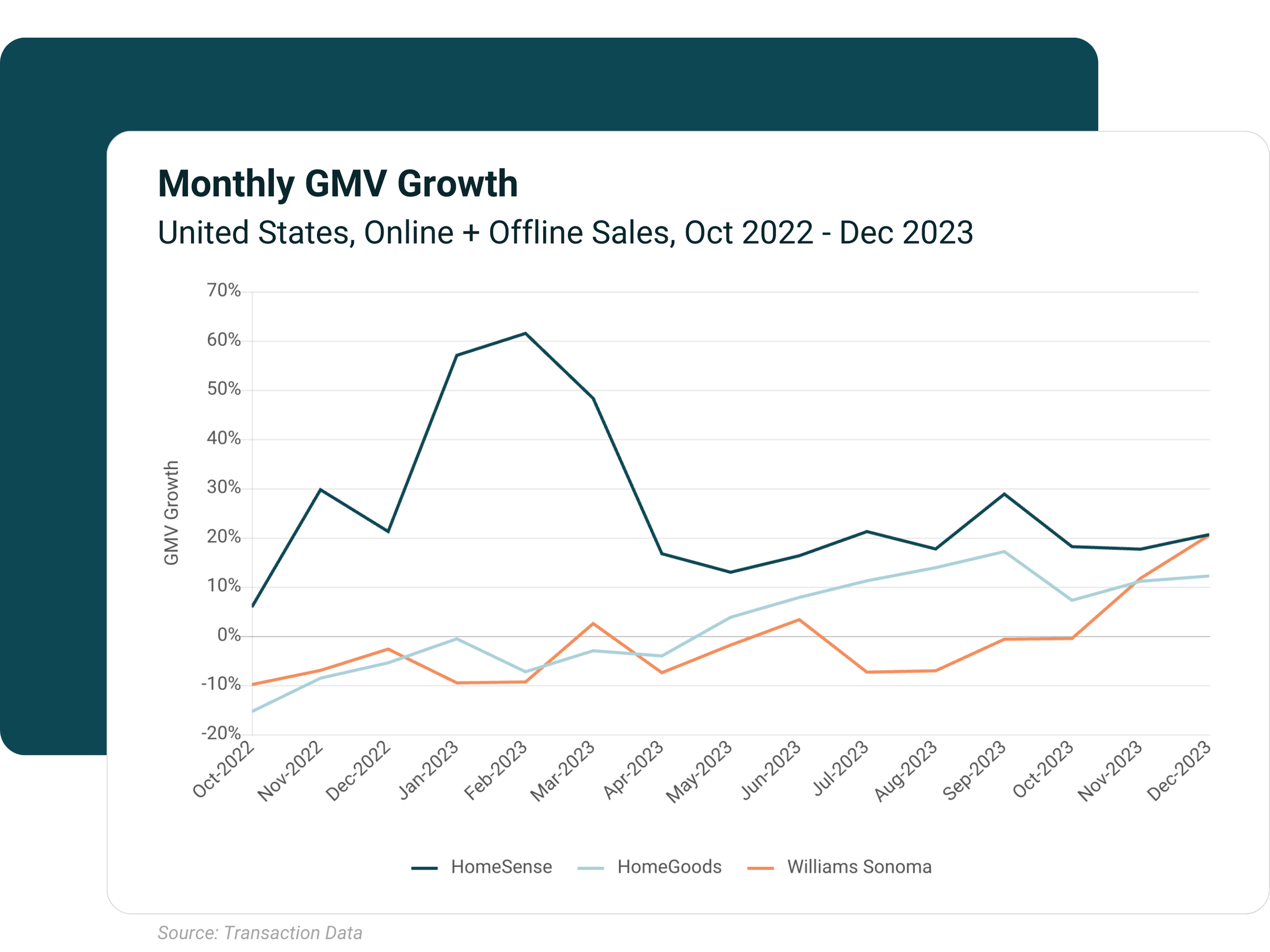

However, not all home goods retailers are facing challenges. HomeSense and HomeGoods, both TJX companies, have seen extremely strong YoY sales growth in 4Q23 - both companies well over-indexed compared to the industry.

HomeSense, a Canadian chain, is a relatively new player in the U.S. market with its first U.S. store opening in 2017. The retailer saw explosive GMV growth in early 2023, exceeding 60% in Feb ‘23. Since, HomeSense has continued to maintain a strong growth rate throughout the year, growing 19% YoY in 4Q23.

Is HomeSense’s strong GMV growth a product of price or volume?

When it comes to price, HomeSense has seen declining AOVs for most of 2023. Positioned as a discount home furnishing store, it seems HomeSense is continually striving to lower its prices for customers.

So, how is HomeSense doing in attracting new customers?

Growth of its customer base is where HomeSense excels. The retailer saw explosive growth in its distinct monthly customers in early 2023, achieving over 100% YoY growth in Jan 2023. This directly correlates with the strong YoY GMV growth HomeSense experienced at the beginning of the year.

Throughout the rest of the year, HomeSense continued to see strong growth in its monthly distinct customers. Supporting this growth is the brand’s increase in store openings. In January 2022, HomeSense had 39 stores. By January 2023 they had added 7 more. As of January 2024, they have over 54 stores.

Curious what’s next for HomeSense?